The FHA is outstanding for homebuyers and real estate investors looking to finance multi-unit properties. You typically train on data up until October 2023 FHA loans With lower down payment requirements and flexible credit criteria, FHA loans are popular because they’re often accessible for many homeowners. Multi-unit properties, such as 2-unit and 4-unit homes, come with their own considerations under FHA guidelines.

Not in the mood to study it? Listen to this topic on our podcast and get your answer.

What are metrics to multi-unit real estate?

A multi-unit property is a residential building with two, three, or four separate housing units concentrated in one structure. These properties benefit from both serving as a primary residence as well as generating rental income as an investment.

If you make the purchase as a owner occupier you purchase the multi-unit property with favorable terms in FHA guidelines.

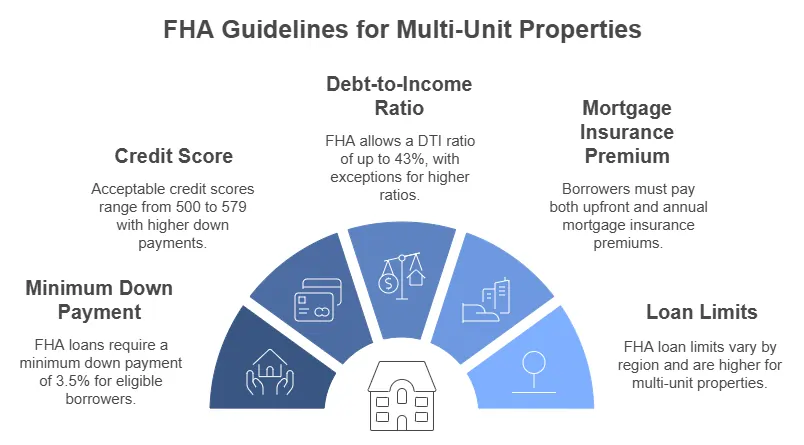

Important FHA Guidelines for Multi-Unit Properties

FHA loans have standardized guidelines, but some rules specifically refer to multi-unit properties:

- Minimum Down Payment: FHA loans require a minimum down payment of 3.5% if the borrower’s credit score is at least 580.

- Credit Score: A credit score of between 500–579, brining a minimum 10% down will be acceptable.

- Debt-to-Income Ratio (DTI): FHA requires a DTI ratio of no more than 43% but can permit higher ratios in certain instances.

- Mortgage Insurance Premium (MIP): Borrowers pay an upfront and annual mortgage insurance premium

- Loan Limits: FHA loan limits depend on the region, and loan limits are generally higher for multi-unit properties than single-family homes.

FHA 2 unit guidelines

Investors love 2-unit properties, which is the perfect first-time buy, moving into one half and renting out the other. Here’s what to consider:

- Owner Occupancy: One of the 2-units must be the borrower’s primary residence.

- Rental income: If the property includes a second unit, FHA allows that rental income to be included in qualification for the loan. Lenders usually want to see a lease agreement and an appraisal to verify rental value.

- Loan Limits: Loan limits for FHA loans are higher for 2-unit properties than single-unit homes, but they vary location to location.

FHA 4 unit guidelines

4-unit properties can generate significant income but have stricter financial requirements:

- Owner-Occupancy Requirement: The borrower(s) must occupy one of the four units.

- Rental Income: Rental income for additional units can also qualify, similar to 2-unit properties. Rental income use for DTI is generally based on 75% of rental income using FHA guidelines

- Loan limits: The FHA has the highest loan limits on any residential properties but those limits may still fall short in high-cost areas.

- The property must meet the minimum safety and livability standards set by the Federal Housing Administration (FHA).

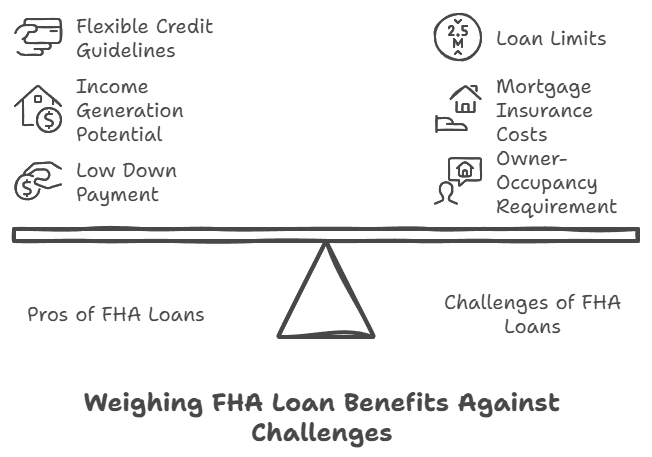

Pros of FHA Loans for Multi-Family Properties

- Low Down Payment: The 3.5% down payment for FHA is significantly less than conventional loans, particularly for multi-unit properties.

- Income Generation: borrow potentially lower their outgoings on the mortgage if they are renting it out.

- Wide Open: FHA’s flexible credit guidelines mean buyers with lower scores can qualify.

Challenges and Limitations

- Owner-Occupancy Requirement: FHA loans may not be used strictly for investment purposes; one of the units must be occupied by the borrower.

- Costs of Mortgage Insurance: FHA mandates both a one-time and recurring mortgage insurance payment, increasing overall expenses.

- Loan Limits: Although FHA loan limits are expansive, high-value multi-unit properties in select regions may require more than what-wise available.

Because of the low down payment requirements, FHA loans are a great way to get into a multi-unit property (especially a 2-unit or a 4-unit) for a fairly low cost. Lower down payments, flexible credit requirements, and the potential of rental income create an ideal Puerto Rico FHA loan profile for the owner-occupant who wants the advantages of owning real estate investment.

But capitalizing on this opportunity means knowing the rules — and working with an FHA-approved lender. For detailed information, visit the U.S. Department of Housing and Urban Development (HUD) or speak with a trusted mortgage professional.