When you consider purchasing a home with an FHA loan, you may wonder if the deal… Buyers often like the Federal Housing Administration (FHA), which provides an insurance program that permits low down payments and eases credit standards. But knowing what exactly is and isn’t a must for buying a home can help you make wise choices.

We’ll discuss the importance of home inspections, whether FHA loans require them and how to handle inspection to protect your investment.

If you have no mood to read it, listen this topic in our podcast!

What Is a Home Inspection and Why Is It Important?

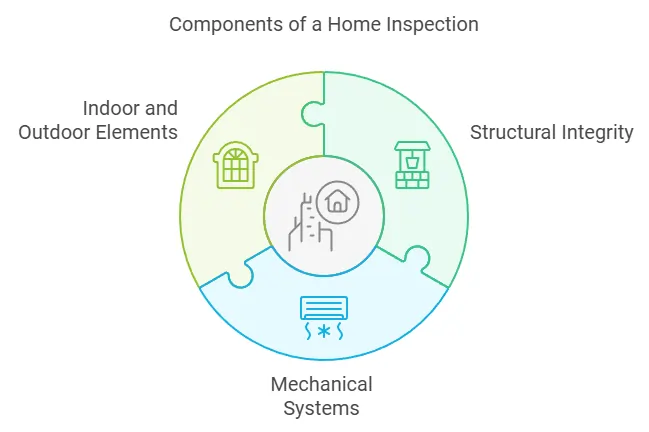

A home inspection is an evaluation of a home’s condition performed by a licensed insurance professionals. The inspector will examine aspects of the home, including:

- Structural integrity: Foundation, walls and roofing

- Mechanical systems: Heating, cooling, plumbing and electrical systems

- Outdoor and indoor end state — windows, doors, flooring, etc.

The home inspection is meant to pick up things that others cannot see that may cost you big bucks in the future. For example, finding out that you have a leaky roof or faulty electrical system before you buy the home could save you from costly repairs down the line.

Home Inspection vs. Appraisal: What’s the Difference?

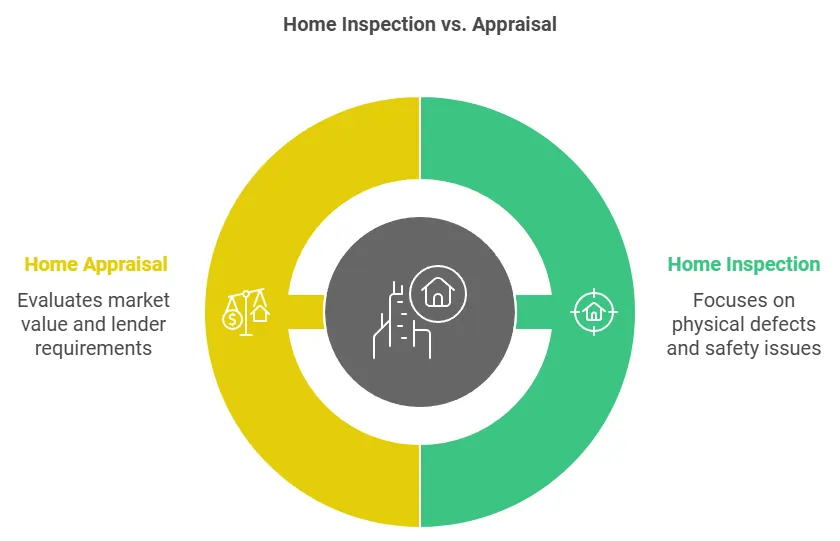

It’s also important to differentiate between a home inspection and a home appraisal — two common terms in the home-buying process. But they don’t do the same thing:

- Home Inspection — Not required by the FHA, but highly recommended for your own peace of mind. A inspection is more about finding physical defects and safety issues that might impact your decision to purchase the property.

- Home Appraisal: A lender requirement for FHA loans. It’s an evaluation of the home’s market value to make sure the lender isn’t lending more money than the property is worth. It also makes sure the home is up to select health and safety standards, but it doesn’t provide the detailed condition report a inspection does.

Though FHA loans don’t require you to order a formal home inspection, the FHA appraisal process will evaluate the home’s value and confirm it meets minimum property standards for health and safety. But an appraisal doesn’t catch all the problems that a full inspection would.

Why Should Buyers Get a Home Inspection for an FHA Loan?

While the FHA doesn’t require a inspection, it’s still a good idea for any homebuyer to get one. Here’s why:

-

Avoiding Hidden Costs:

The moments of truth should not reveal themselves later at a cost that takes a chomp out of the original discounted property price. Not only can these problems be expensive to fix, they may lower the value of your home long term.

- Stronger Negotiating Position: If the inspection reveals defects, you could negotiate a lower price or request that the seller fix problems before closing. Doing so could either save you thousands of dollars or prevent you from purchasing a home that has serious problems.

- Peace of Mind: A inspection provides the assurance that the property that you are purchasing is safe and structurally sound. It makes sure that you aren’t moving into a home that might need expensive renovations shortly after you buy it.

What Is an FHA Appraisal & How Does It Work?

Although a FHA loans do NOT require a inspection, they do require an FHA appraisal. The appraisal accomplishes two major tasks:

- Establishing the Home’s Market Value: The appraiser will establish the fair market value of the property in order to confirm that the loan amount does not exceed the home’s value.

- Confirming Property Meets FHA Standards: The FHA has minimum standards for properties to ensure that they are habitable and safe. That might mean the home must have working plumbing, a working heating system and no major health or safety issues, for example.

If the appraiser finds that the property is not up to those marks, the loan may be conditional upon repairs before approval by the lender.

Is a Home Inspection Required for FHA Loans?

In short: no, there are no home inspection requirements for FHA loans. But while the FHA appraisal will check off certain boxes about safety, it won’t provide the level of analysis that inspection will. Therefore, we highly recommend a inspection for any buyer who wants to guard against unexpected repair expenses and verify that the property is in sound condition.

Commonly Asked Questions (FAQs)

How much is a home inspection?

The price of a home inspection usually goes for between $300 and $500, depending on the size of the home and the area. Here the fee is extra but it might save you thousands — down the line — if serious problems are found.

Which home inspections can I skip if I get an FHA loan?

Even though a home inspection is not mandatory on an FHA loan, you will definitely want one to protect your investment. Performing an initial assessment will unveil any issues that the FHA appraisal may not catch, saving you money on repairs and avoiding a dangerous living environment.

Conclusion: Should You Get a Home Inspection?

Home inspections are not required for FHA loans, but getting a home inspection is a crucial step in the home-buying process, and it cannot be missed. It can give you peace of mind, discover problems you wouldn’t have noticed and possibly save you money down the road.

If you’re looking at FHA loans, make sure to talk to your lender or your real estate agent about both the appraisal and the home inspection. That will help ensure you’re making a smart investment and will fully understand the condition of the property.

Is Your Advice Related to FHA Loans or Home Inspections? Get in touch today for a free consultation and allow us to take you through the home-buying process!