If you’re thinking about buying a home, the first step is learning the lingo — and one phrase you’re sure to encounter is mortgage. So what is a mortgage, and how does it work, really? In this guide, we’ll walk you through all of the ins and outs of mortgages so that when the time comes for you to buy a home, you feel confident.

If you are not in a reading mood then no problem! Listen to our podcast for the answer to your question.

What is a Mortgage?

A mortgage is thus just a loan used to purchase real estate! A mortgage is considered a secured loan since, unlike other loans, it is secured by the property itself. Foreclosure gives the lender the right to re-possess the home if the borrower fails to pay their bills, in other words.

How Do Mortgages Work?

Basically, a mortgage works just as any other type of borrower-lender agreement. Every mortgage loan requires a borrower, and there is a contract between the lending entity of the money and the individual who accepts it, to re-pay either over a given time frame (most frequently 15 to 30 years). Your 12 monthly payments combine both your principal (the amount you borrow) and interest (cost of borrowing).

Types of Mortgages

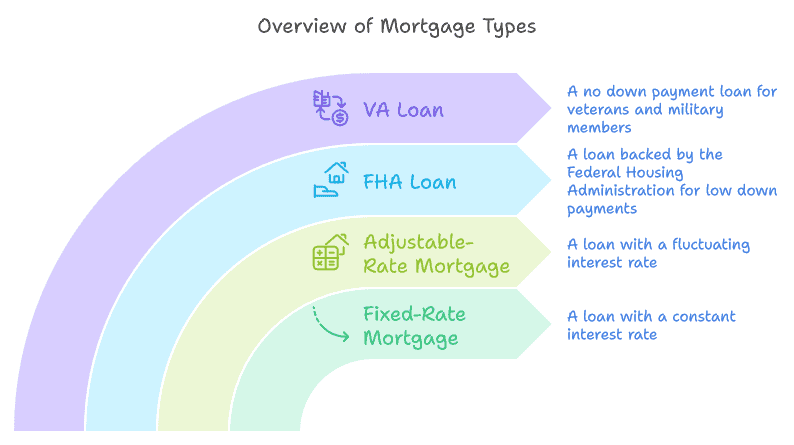

Well, there are several types of mortgages and each type of mortgage owns specific advantages. It’s most often presented in its various forms:

-

Fixed-Rate Mortgage

A fixed-rate mortgage is a loan whose interest rate remains constant throughout the life of the loan. One thing is that you can bank on it, which is why it is usually the go-to for a mortgage.

-

Adjustable-Rate Mortgage (ARM)

Adjustable-rate mortgage, or adjustable loan: A loan with an interest rate that can go up or down. It often starts low for a few years and then rises to market levels.

-

FHA Loan

FHA loans are backed by the Federal Housing Administration and are most commonly used by first-time homebuyers or those with a lower credit score, as they allow for a lower down payment than conventional loans.

-

VA Loan

VA loans are no down payment loans available to eligible veterans, active-duty military members and their families, among other features.

Key Terms to Know in a Mortgage

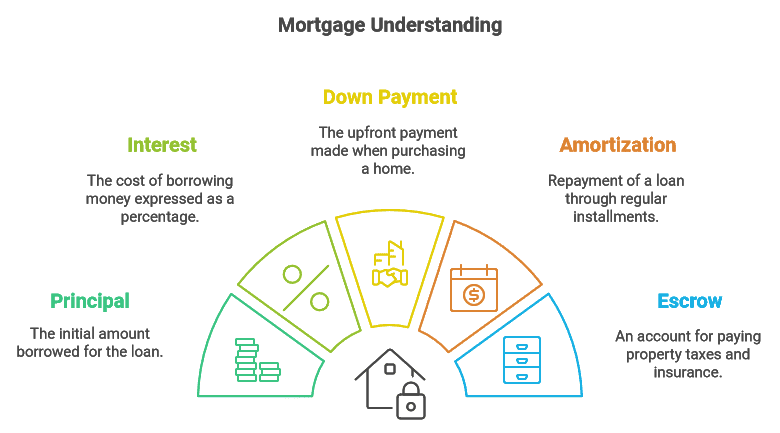

Understanding common terms can help in reducing the feel of being overwhelmed. Here are a few essentials:

-

Principal: The initial amount you borrow regarding the loan.

-

Interest — The charge for borrowing money, stated as a percentage.

-

Down Payment — The sum of money you pay upfront when purchasing a home.

-

Amortization: Repayment of a loan over time in regular installments of principal and interest.

-

Escrow: An account in which property taxes and insurance are paid.

How to Qualify for a Mortgage

The mortgage approval process depends on many different variables, including credit score, debt-to-income (DTI) ratio, employment history, and down payment. Good credit scores and low DTIs help in qualifying for a loan at a good rate.

The pros and cons of taking out a mortgage

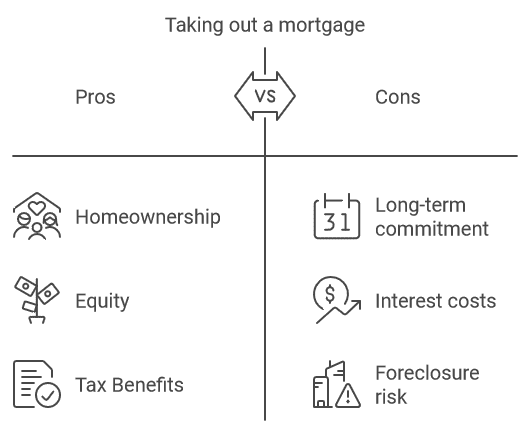

Having a good knowledge of both sides of the coin will help you decide whether the loan is right for you or not.

Pros

-

Homeownership: With a mortgage, you can buy a home but pay off the full price over time.

-

Equity: With a mortgage, you gain equity for every dollar you repay on your loan.

-

Tax Benefits: In many instances, the interest you pay on your mortgage is tax-deductible.

Cons

-

Lifetime Partnership: Mortgages are often long-term commitments, often lasting 15-30 years.

-

Learn more Interest Costs: You will pay interest over the loan amount, which will enlarge the total of a home.

-

Foreclosure Risk: You could lose your home if you default on the payments.

Final Thoughts: Is a Mortgage Right for You?

Obtaining a loan is a major financial responsibility, but for most it is an unavoidable act of ownership. If you see how mortgages work–the types out there, what lenders are looking for–you can weather the storm of a loan with confidence.

FAQ

Q: What credit score do I need?

A: Generally, at least 620 is advisable, although some loan programs will accept lower scores.

Q: May I pay off my loan sooner than planned?

A: YES — Many loans can be paid off early. You can pay them off at any time, although some lenders may charge a prepayment penalty.

Q: What if I miss a payment?

A: Missing a payment can result in late fees and could lower your credit score. Several skipped payments could lead to foreclosure.

Excited to start the journey toward the purchase of your dream home? Start searching for you mortgage and reach out to a lender you trust in order to find your best loan options possible today! Whether you’re a first-time buyer or refinancing, understanding your mortgage can make all the difference.