If you’re struggling with a low credit score but need to access the equity in your home, you may be asking your self if you can even a home equity loan at all. The bright side is that it’s not totally out of reach. Securing a home equity loan with bad credit can be difficult, but it is possible. Let’s explore how.

If you don’t want to study, you want to listen and find out the answer to this question, come in our podcast.

What Is a Home Equity Loan?

A home equity loan is a type of loan that allows homeowners to borrow money using the equity they’ve built up in their home. Equity is how much your home is worth minus how much you owe on your mortgage. Such loans usually carry fixed interest rates and must be repaid with regular payments.

But lenders look at many things to determine whether to approve a loan, and your credit score is one of the biggest factors.

Will You Have the Capability to Get a Home Equity Loan if You have Bad Credit?

In short,yes — but the long answer is that it depends on your situation. If there are other characteristics of your financial profile—like a high income, lots of home equity, or a low loan-to-value ratio (LTV)—to offset your low credit score, lenders may approve the application.

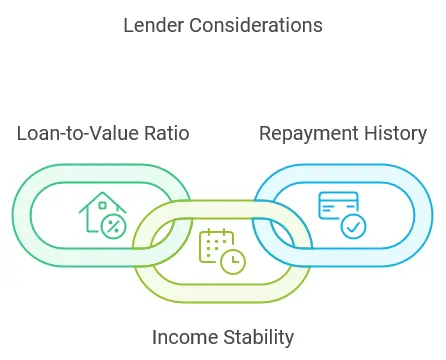

Key Factors Lenders Consider

-

Loan-to-Value Ratio (LTV):

Traditionally, lenders want to see lower LTV ratios, typically 80% or less. This means you have to have a sizeable amount of equity in your home.

- Incomes and Jobs Stability:

Even if you have bad credit, a consistent income and stable employment history can provide lenders peace of mind that you’ll be able to pay the loan back.

-

Repayment History:

You are charged late fees and could have your loan sent to collections — all of which can be prevented.

Tips to Improve Your Chances

Improve Your Credit Score Before You Apply:

Take steps — such as paying off small debts, disputing mistakes on your credit report and avoiding inquiries from new credit — to help.

Consider of lowering Your Debt — to — Income ratio:

Paying down your existing debt can make you a more attractive applicant.

Use a Co-Signer:

A borrower with a high credit score who co-signs on the loan can improve your chances of getting approved, since they share liability for the loan with you.

Other Options to a Home Equity Loan

If a home equity loan seems beyond your grasp, here are some alternatives to consider:

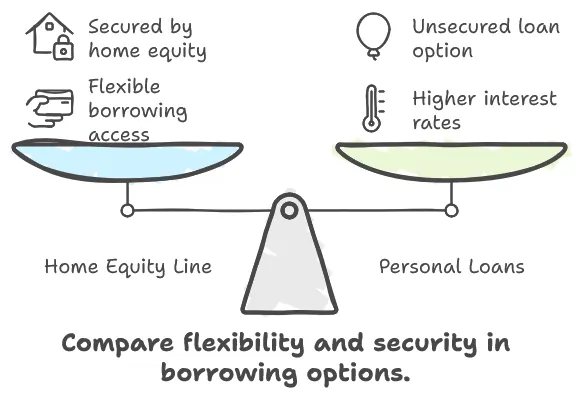

Home Equity Line of Credit (HELOC):

Like a home equity loan, it works more like a credit card, letting you borrow as needed.

Personal Loans:

These may have higher interest rates, but they don’t require you to put your home on the line.

Debt Restructuring or Refinancing:

You may create some elbow room with refinanced mortgages or debt consolidation.

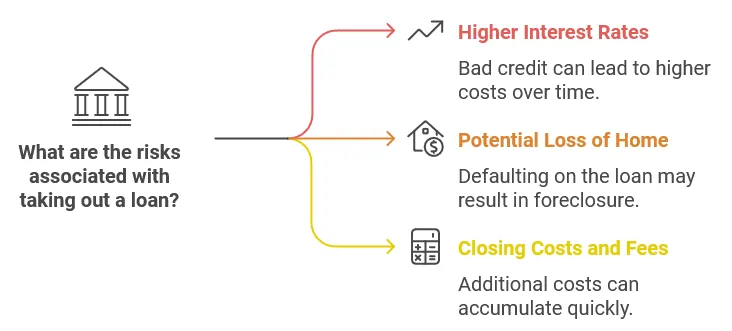

Risks and Other Key Questions

Higher Interest Rates:

If your credit history is bad, you will probably be presented with a higher interest rate, leading to a much higher cost of the loan.

Potential Loss of Your Home:

In the case of a default on the loan the lender can foreclose on your house to recoup their money.

Closing Costs and Fees:

Just be aware that those incremental bills can add up rapidly.

Conclusion

Although it is true that you can secure a home equity loan with bad credit, it is not as easy as it sound and requires careful planning and good financial knowledge. When you assess your options, remember to improve your credit score and look for alternatives when possible. Most importantly, talk to a financial adviser or lender to find out what’s best for you in your particular situation.