Buying a house is one of the largest financial decisions many will make, and getting a loan can sometimes be difficult, especially for first-time homebuyers. The Federal Housing Administration (FHA) loan program was created to help open the door of homeownership, specifically for people with moderate or low incomes. This is one of the most attractive features of an FHA loan. In this article, we discuss everything you need to know about what an FHA loan down payment is, how it works, and why it is important.

Requirements for Down Payment on an FHA Loan

The most obvious advantage of an FHA loan is the low down payment.

Minimum Down Payment

Borrowers with a credit score of 580 or greater can qualify for a down payment of just 3.5% of a home’s purchase price. So if you were buying a home that costs $250,000, for instance, the minimum down payment would be $8,750.

Lower Credit Scores

If your credit score is in 500 to 579 range, you can qualify, but will need to make a down payment of at least 10%.

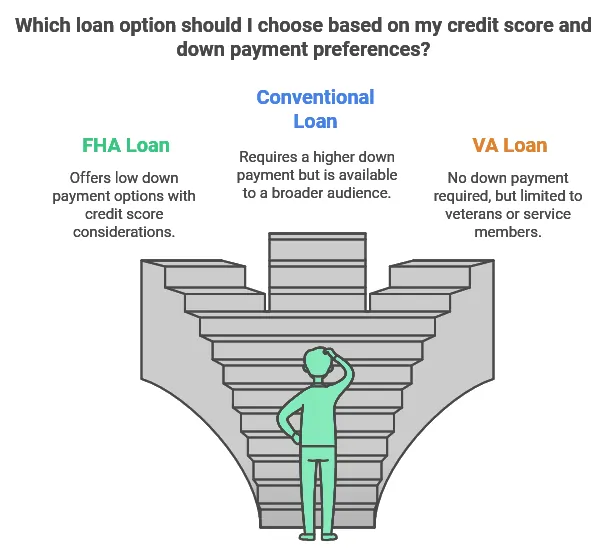

Comparison with other types of loans

- Conventional Loans: Minimum Down Payment: 5–20%

- VA Loans: These usually have no down payment, but they’re available only for qualifying veterans or service members.

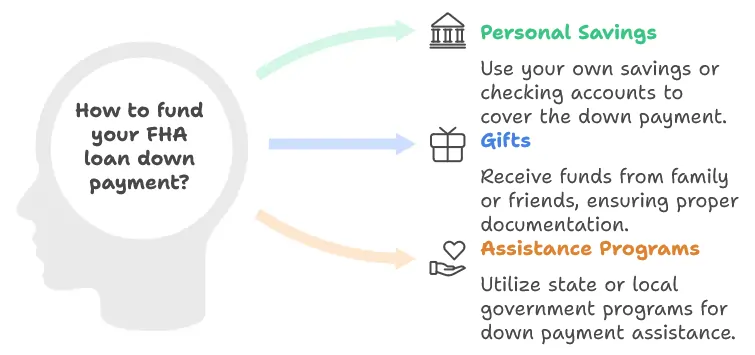

Sources of Down Payment Funds

With FHA loans, that’s a little less strict — you have some flexibility in how you come up with your down payment.

Personal Savings:

Down payment The savings or checking accounts you can use to pay for the down payment

Gifts:

FHA guidelines allow family members, employers, or close friends to gift funds for your down payment. But you do have to document that the money is a gift, not a loan.

Assistance Programs:

Like some other state and local governments, it has down payment assistance programs available to homebuyers. They often pair well with FHA loans.

Pros of Paying More Than the Minimum Down Payment

Although the minimum down payment for an FHA loan is low, putting more money down upfront has its benefits:

- Smaller Monthly Payments: Putting more money down means you’ll borrow less money to pay off the car with, and in turn, makes each month’s payment lower.

- Lower Mortgage Insurance Costs: FHA loans require Mordgage Insurance Premium (MIP), but upfront (less than 10 percent) can reduce mortgage insurance costs.

- More Competitive Interest Rates: Putting down a large down payment increases the chance of qualifying for a competitive interest rate.

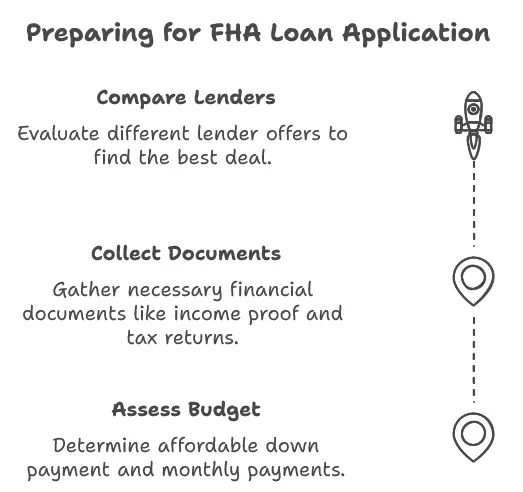

Tips for FHA Loan Applicants

If you’re thinking of applying for an FHA loan, here are some tips to make sure you’re ready:

- Assess Your Budget: Start by figuring out how much you can afford in terms of a down payment and monthly mortgage payments, but without stretching your finances too thin.

- Collect Financial Documents: Prepare to share proof of income, tax returns and bank statements as part of the application process.

- FHA refinance assistant: Shop around for lenders Compare offers — using data from October 2023.

Can You Put 20% Down on an FHA Loan?

You can certainly put 20% down on an FHA loan, but you don’t have to. Although the lowest down payment you could make on an FHA loan is 3.5% if you have a credit score of 580 or higher, there is no maximum amount that you can pay as a down payment. As a result, having a bigger downpayment like 20% will help reduce your loan amount thus lessening your monthly payments and lowering your mortgage insurance. If you’re putting 3.5% down, though, remember that the FHA still requires mortgage insurance premiums (MIP) no matter the down payment amount — unless you refinance into a conventional loan later.

Conclusion

FHA loans are great for buyers wanting to buy a house and bring a lower down payment with less challenging credit considerations. Guidance on both the payment-understanding and assessing finances to make a decision on homeownership part is the goal of this as an up to date consumer of this information. So whether you’re working toward the minimum or kicking in more money up front, being aware of your options can help you realize your dream of home ownership.

If you’re ready for your first step visit an FHA-approved lender or look up local assistance programs to ease your homeownership journey.