What exactly is an FHA Home Inspection?

An FHA home inspection is an essential component of buying a house with an FHA loan. While a general home inspection looks for possible problems that may make a buyer think twice about making a purchase, an FHA inspection ensures a dwelling meets the standards for minimum safety, security and soundness, as defined by a federal agency called the Federal Housing Administration (FHA). This is one of the final steps before closing and is important for both the buyer and the lender to ensure that the home is livable and is worth the loan amount.

If you are not in the mood to study, listen to this topic on our pod and find your answer.

What Is Reviewed During an FHA Inspection?

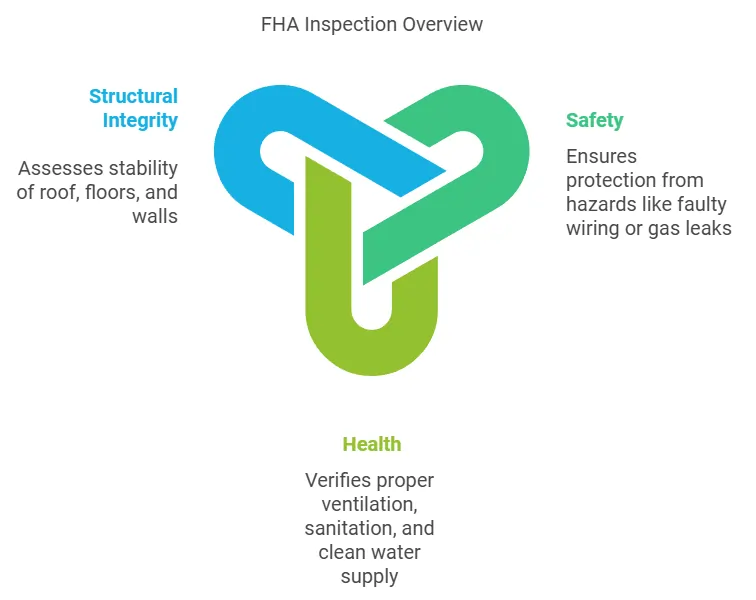

FHA Inspections: FHA inspections are an appraisal of three things:

- Safety: Making sure the home is safe from any kind of risk factor, like faulty wiring or gas leaks.

- Health: Checking that ventilation, sanitation and a source of clean water are in place.

- Structural Integrity: Examining the overall stability of the structure comprising of the roof, floors, and walls.

Important FHA guidelines for approving properties

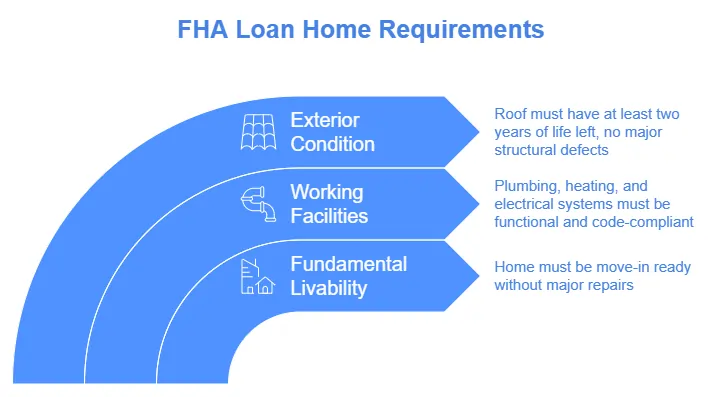

In order for a home to qualify for an FHA loan, it must meet the following criteria:

- Fundamental livability: You should be able to move in without doing major repairs.

- Working facilities: The plumbing, heating and electrical systems need to be functional and up to local codes.

- Exterior condition: The roof should have at least two years of life left, and no major structural defects.

FHA Inspection Failures: Common Reasons

Some common issues that could make a home fail an FHA inspection include:

- Significant structural damage or foundation crack.

- Poor access to vital utilities such as water or electricity.

- Absences of railings on stairs or balconies

- Peeling lead paint. Homes built before 1978.

Getting Ready for an FHA Inspection

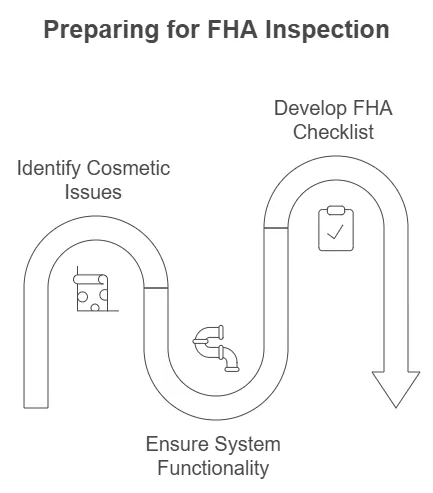

To seek to not have any further delays or issues home-owners can take steps to proactively prevent:

- Taking care of cosmetic issues, such as frozen panes or torn carpeting.

- Making sure all systems (plumbing, heating, etc.) work.

- Developing a checklist based on FHA guidelines to pinpoint any potential problems and see if there is a way to resolve them.

FHA Inspection vs. Appraisal: What Are the Differences?

FHA loans require both an FHA inspection and an appraisal, but these two things are separate:

- Inspection: Special attention is given to ensuring the property complies with safety and livability standards.

- Appraisal: Establishes the fair market value of the home and confirms it matches the loan amount.

Recognizing this difference helps buyers and sellers navigate the FHA process in a more effective manner.

Advantages of Purchasing a Home Using an FHA Loan

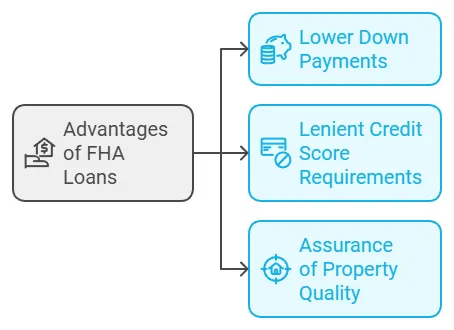

Here are some of the significant advantages of FHA loans — especially for first-time home buyers:

- Lower down payments: As low as 3.5% for qualified buyers.

- More lenient credit score requirements: Better for more people.

- Assure you property is of good quality — The FHA inspection will assure that buyers do not spend their hard earned money on a make-shift property

What is the Role of FHA-Approved Inspectors

Inspections for FHA compliance must be performed by a licensed inspector knowledgeable in FHA guidelines. These inspectors:

- Confirm adherence to FHA standards.

- Offer an in-depth report for lenders and buyers.

- Assisting to find out what it takes to bring wether it was the property up to standards.

The Expense and Time Frame for FHA Inspections

An FHA inspection generally costs $300 to $500, depending on the property’s location and size. It usually takes a few hours for the inspection and the report will be provided within 24-48 hours.

FHA Inspections FAQ

What are FHA requirements in all 50 states?

FHA standards are universal but individual building codes can affect specific requirements.

If a home fails the inspection, can it be repaired and re-inspected?

Yes, the homeowners can do the repairs and order a re-inspection.

Do All FHA Loans Require An FHA Inspection?

Yes, unless the loan is for putting money down on a property that already meets the FHA specs, like a new construction.