When it comes to purchasing a house, or making improvements to an existing one, many homebuyers and homeowners have turned to the Federal Housing Administration (FHA) for assistance. There are several loan programs that the FHA offers which makes it easier to own a home. But something prospective homeowners often wonder is whether there are FHA construction loans, and for people eager to get a head start on building their new dream home or renovating an existing property.

We will answer that in this article along with going over some of the loans available for construction or renovation and experiencing the FHA construction loan limit and maximum mortgage amount.

For those of you who’ve little desire to read, join the topic on our podcast here to find your answer.

Does FHA Offer Construction Loans?

FHA offers a number of loan programs that may apply to new construction or renovating an existing home. The main loan programs of FHA that serve this objective are;

- FHA 203(k) Loan

- FHA Energy Efficient Mortgage (EEM)

The programs are all designed to let you combine the purchase of a home with either the cost of construction, repairs or energy efficiency improvements into one mortgage.

FHA 203(k) Loan

FHA 203(k) — These FHA-backed loans are the most common for renovations. RenoFi breaks out new home construction costs from renovation and repair projects, allowing homebuyers and those that already own a home to combine various types of debt (including renovation and repair) into one single loan at the lowest available interest rate. The 203(k) can be applied to just about any project, large or small.

- Standard 203(k): Puts a cap of about $35,000 on the renovation costs, but some structural repairs and updates if major remodeling.

- Limited 203(k) – This is for smaller renovation projects where the total cost of repairs or improvements will not exceed $35,000.

This type of FHA 203(k) loan is good for someone who is buying a fixer-upper or existing home that needs remodeling before they move in, but Imagine the havoc you would wreak having to qualify for and pay for a home and then somewhere process an additional renovation loan!

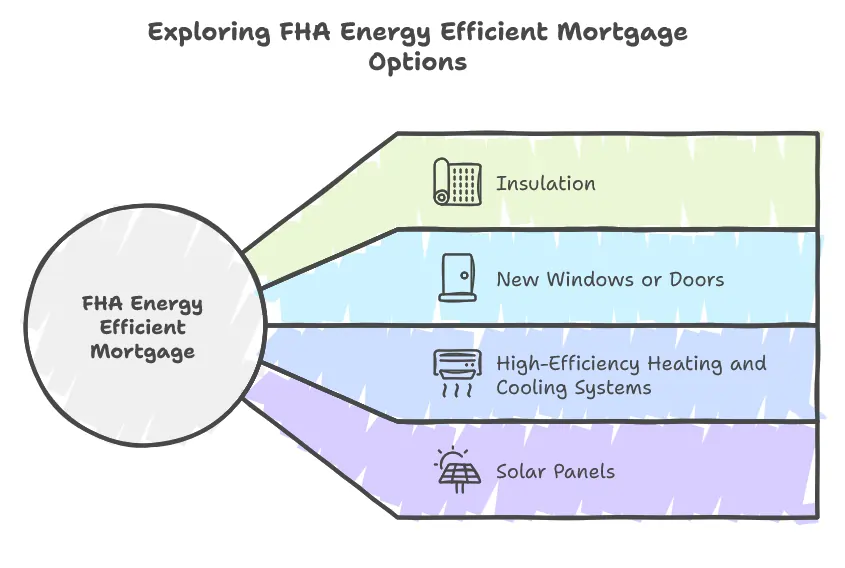

FHA Energy Efficient Mortgage — FHA EEM

FHA EEM FHA Energy Efficient Mortgage (EEM) enables homeowners to save money on their utility bills by financing the cost of adding energy-efficient features to new or existing housing as part of their FHA-insured home purchase or refinancing mortgage. Not a true construction loan, but the funds can be used to finance upgrades which may help lower utility costs or make a home more sustainable.

EEMs may be used to finance improvements to:

- Insulation

- New windows or doors

- High-efficiency heating and cooling systems

- Solar panels

These can be paired with an FHA 203(b) purchase loan or an FHA 203(k) renovation loan.

FHA Construction Loans Limits

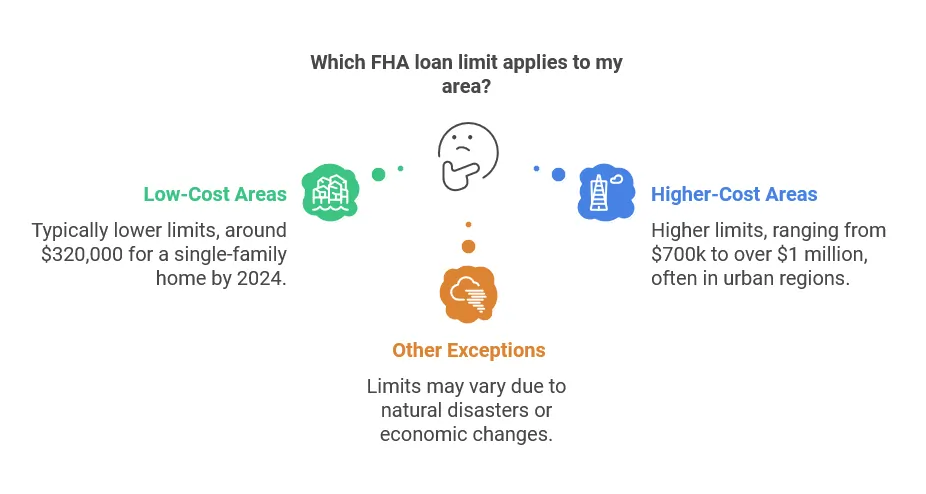

FHA rehabilitation loans, which can also be used for a new construction home loan in the 203(k) program requires a maximum of $35,000 not including closing costs. This can be different from where you live… The FHA loan limit is based on county and will be updated each year. While it is true that standard FHA loans do not have maximum income rations, there are certain FHA loan limits which may apply to your mortgage.

- Low-Cost Areas – The FHA loan limit isnormally lower in low-cost areas. Those ceilings are typically $320,000 for a single-family home by 2024.

- Higher-Cost Areas: Loan limits in these higher-cost areas are a lot more, usually located in urban or high cost-of-living regions. The cap can be anywhere from $700k to well over $1 million, depending on the area.

- Other than Federal Exceptions: There are other Personal Loan Restrictions that may have higher and lower limits, these include the regions affected by natural disasters, or those experiencing economic changes.

The FHA 203(k) loan follows these basic guidelines, but the total amount financed (including the purchase and repairs) must be within these regional limits.

FHA Maximum Loan Amount

The max loan amount for FHA means the most you can finance with an FHA-insured mortgage. This is county specific and changes annually.

While in low-cost areas the maximum loan limit on a single-family home is usually about $320,000 most often, this figure can be substantially higher in high-cost areas. In the case, of say San Francisco or New York City, this dollar limit may be significantly higher than $800,000.

The FHA 203(k) program is required to adhere to the same limits as standard FHA loans. This means that if you are buying a property with 203(k) loan and will renovate it, in total — you can not borrow more than the FHA limits for your area.

What Are The Perks of Constructing With FHA Financing?

Although FHA doesn’t offer a traditional construction loan, its programs have several in-built advantages for borrowers.

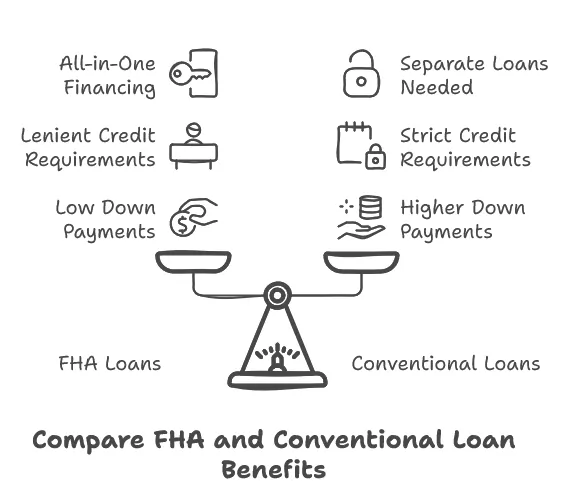

- Low down payments: This is one of the most appealing benefits of an FHA loan. FHA only requires 3.5% as a minimum down payment, while other types typically need at least 5%.

- Lenient Credit Requirements: FHA loans generally have looser credit requirements than conventional loans, particularly for borrowers who have experienced credit problems in the past.

- FHA 203(k) loans are an all-in-one financing solution: there is more convenience and a lower cost to the borrower of taking a home purchase loan+home renovation loan compared with two separate loans.

- Longer Repayment Terms: FHA loans typically 30-year repayment terms; therefore a lower monthly payment

FHA Construction Loans vs. Traditional Construction Loans

The Federal Housing Administration (FHA) provides excellent options for homebuyers and homeowners to build a home or renovate an existing one, but here are some other differences between FHA-backed construction loans and traditional construction loans you should know.

- Traditional Construction Loans: This loans are most commonly short-term loans used by landowners or builders to build a home while the owner is an occupant in both renovation of a new home. Typically higher credit scores, larger down payments and possibly higher interest rates.

- FHA 203(k) Loans: Easier for first-time homebuyers, or anyone with less than spectacular credit. FHA 203(k) loans require lower down payments Some loan programs allow you to borrow a large percentage of the cost upfront, built in the form of a low- or no-down payment plan.

Is an FHA Construction Loans Right for Me?

FHA 203(k) loan: An FHA- backed construction loan can be the perfect solution for many first-time homebuyers, especially if that bungalow you have your eye on is a little less than move in ready. Nonetheless, it is vital to bear in mind that these loans might not be appropriate in every instance. If you are in the planning stages of a larger new construction project, then you might find a traditional construction loan to be more appropriate.

What to know before choosing an FHA construction loan

- Check Your Finances: Be sure that you can afford the upfront cost of buying the property as well as fixing it up.

- Verify Eligible Loan Amount: Confirm that your ideal loan number (with renovations) meets the FHA loan limits in your area.

- Talk to a Lender: FHA 203(k) loans are more involved than typical FHA-backed loans, and it helps to contact an FHA-approved lender from the start.

Conclusion

Although FHA typically does not dole out regular construction loans, it is a worthwhile alternative for many homeowners, as there are the FHA 203(k) loan and the FHA Energy Efficient Mortgage that can both be utilized to fund any construction projects sizeable or small. These programs allow homebuyers and homeowners to finance the purchase of the home and any necessary repairs or renovations in a single loan, with lower down payments, more lenient credit requirements.

If you are thinking about an FHA-backed construction or renovation loan, check the limits and maximum loan amounts specific to your area to keep your project within budget. A FHA loan can be a time-consuming process without the right guidance, however if you are prepared correctly and have all the help in your corner an FHA construction loan may be the perfect option to build your future dream home or redevelop your current palace.